On January 17th, 2023, the Superintendence of Companies, Securities, and Insurance issued a release on the presentation of the financial statements, the most relevant content of which is detailed below:

a) As of January 20th, 2023, the institutional website will be available to report the financial statements and upload the corporate documents of the 2022 fiscal year.

b) The due date for the submission of the information is April 30th, 2023.

c) No extensions will be granted for the submission of financial and corporate information.

d) Deadlines breaches may be sanctioned with fines of 1 up to 12 statutory minimum wage (currently, from US$450 to US$5.450).

For more information do not hesitate to contact our Corporative Practice Partner, Álvaro Sevilla (asevilla@tzvs.ec).

© TobarZVS

This publication contains information of general interest and may not constitute a legal opinion on specific matters. Any particular analysis, shall require legal advice from the Firm.

Teleworking could be:

By ZVS Tobar in CORPORATE, M&A , Featured , News and Bulletins

The Ecuadorian Hydrocarbons Minister, along with other authorities of this field, visited Houston the first days of October to promote new projects and investment opportunities in the oil & gas sector. These projects and investment opportunities are both in the upstream and downstream sectors.

Positive news for investors seeking upstream projects, a sector that has been left almost exclusively to public investment, is the return to a participation sharing agreement, leaving behind the failed and most controversial service contract agreement that set a tariff per produced barrel of oil.

With the return to the participation sharing agreement under which the investor directly participates from the oilfield production, the Ecuadorian government sends a clear signal to the private investors seeking to improve oil production and stimulate the exploration of the South East of the Ecuadorian Amazon region.

These are the 4 investment projects in the agenda of the Ecuadorian government:

1. Intracampos Bid Round

The so-‐called “Intracampos” fields are composed by 8 blocks that include 13 fields, located in the Northeastern Ecuadorian Amazon region and are amongst oilfields in production. The total amount of proven reserves of the Intracampos oilfields is 157.3 MM bls of oil (907.5 MM bls of OOIP).

For the development of the Intracampos oilfields, the Ecuadorian government is expecting an approximate investment of USD 1.2 billion.

The Intracampos bidding round will probably be launched by the end of November or first days of December 2017.

2. South East Blocks

The South East of the Ecuadorian Amazon Region continues to be unexplored. Notwithstanding, it is an area that holds high expectations as there have been found 2 oil bearing reservoirs in Block 80 and the discovery in Block 64 of Peru (Situche Central) that is located in the border between Ecuador and Peru.

After the failed South East bidding round of 2013, under a service contract model by which the investor was paid with a tariff per produced barrel, this time the Government has made it clear that this new bid will be held under a participation sharing agreement, a model where investors are given an incentive as they can take advantage of any upside during the life of the contract.

This bidding is expected to be launched by the Ecuadorian government the first half of 2018.

3. Pacific Refinery

This was the flagship project of former President Rafael Correa´s administration, but it didn’t manage to attract investors due to the high amount of investment and unclear business model proposed.

This project’s justification is the limited refinery capacity of the country that is still unable to meet the internal fuel demand and, in turn, forces the government to make imports.

The Ecuadorian government has announced that this project requires an investment of USD 8.2 billion, almost half the sum announced by the prior government. Now the government expects private investment for the development of this project as it has stated that it would not compromise public funds.

The business model proposed for the development of this project has two options: (1) the payment by the Ecuadorian State of a tariff per refined barrel, which involves a BOT project; or, (2) the Ecuadorian State would sell the oil to the refiner at international price, and the Ecuadorian State would commit to buy the refined oil products from the refiner at international price.

Unlike the proposal by the former Government to refine oil imported from Venezuela, the current proposal is to refine the oil produced from the called ITT (Ishpingo-‐Tambococha-‐Tiputini) Blocks located in the Ecuadorian Amazon Region. Currently, the Tiputini oilfield produces 50,000 bpd, and the Government expects to increase its production to 100,000 bpd. The Ishpingo and Tambococha oilfields are expected to be developed in the short term.

The processing capacity of the Pacific Refinery has been proposed on 300,000 barrels per day.

4. Monteverde Maritime Project

The maritime terminal of Monteverde is an infrastructure in which the Government has already invested close to USD 600 million. The proposal is to find either a strategic partner to invest approximately USD 300 million for the development of a Regional Hub Storage and Distribution Center, or a private investor to buy this project to directly develop it.

This project finds attractive the fact that the Pacific Coast has a storage deficit for liquid products (fuel, chemicals) that, in turn, becomes an opportunity for the development of a Regional Hub Storage and Distribution Center. Moreover, taking into account the strategic position of Ecuador in the Pacific and the existence of infrastructure that needs to be improved and maximized.

The business model for this project has been left open to the investor needs, and can be developed under a concession model, a contract for the use of the infrastructure, a joint venture, or any other business model proposed by the investor.

By Tobar Bernardo in CORPORATE, M&A , Featured , News and Bulletins

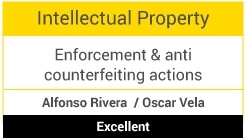

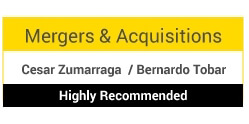

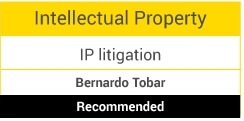

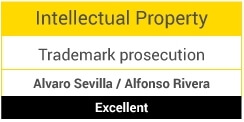

We are very proud to share the 2019 rankings of our firm and our specialists, published by Leaders League, with our continued commitment to offer our highest standards and to permanently seek to improve our clients’ satisfaction.

By ZVS Tobar in CORPORATE AND M&A , CORPORATE, M&A , Featured , INTELLECTUAL PROPERTY AND ANTI-PIRACY , News and Bulletins

The latest edition of Leaders League 2021 includes the firm as recommended and highly recommended in the areas of Arbitration, Competition & Antitrust, M&A and Corporate Tax for Ecuador. Team members are also recognized in their respective areas. Oscar Vela and Andres Larrea for Arbitration; Bernardo Tobar and Cesar Zumarraga for M&A; and Alvaro Sevilla and Bernardo Tobar for Competition & Antitrust.

Visit the full rankings in Leaders League.

By ZVS Tobar in ANTITRUST & COMPETITION , CORPORATE, M&A , Featured , NEGOTIATION, CONFLICT RESOLUTION AND DISPUTES , News and Bulletins , TAX CONSULTANCY