Industrial mining being an engine of Ecuador’s economy is an unquestionable fact. Likewise, there is no debate that responsible mining can be the main source of jobs and exports in the years to come for Ecuador. However, little has been said about the importance of mining in geopolitics and the country’s influence in the region and the world.

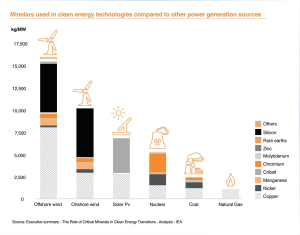

The race between countries to decarbonise the planet does not stop. In the interesting article published by the global firm White & Case , in 2023 clean energy received 70% more investment than fossil fuels. For the first time in the world solar energy alone will receive more new investment than oil, amounting to more than $1 billion per day. Every dollar of that new investment in turn requires extracting or recycling and refining more minerals. All clean energy solutions require metallic minerals and especially copper as we can see in the chart below.

Source: Executive summary – Toe Role of Critica! Minerals in Clean Energy Transitions – Analysis – IEA

The pandemic, the 2021 energy crisis, and the conflict in Ukraine have forced countries to diversify energy supplies and the concentration of fuel and energy supplying countries to avoid systemic risk to national security and global decarbonisation policy. Countries dependent on mineral exports are seizing the opportunity of limited supply in the face of rampant demand; gaining advantages and preferential treatment from mineral-consuming countries dedicated to industrial and technological purposes.

China remains the world’s largest producer, refiner, and consumer of metals, and Western countries are adopting energy security policies to protect them from the threat of a country that maintains market hegemony in rare earths and metals. Chile, for example, is beginning negotiations with the United States for a trade agreement on critical minerals that will undoubtedly elevate the South American country’s importance on the continent.

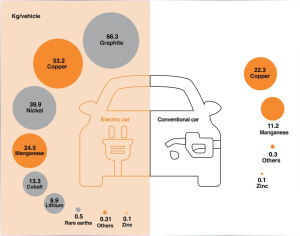

A fact that caught my attention from the presentation of the CEO of an Australian company is that 70% of the oil used for industrial purposes comes from 15,000 active wells around the world (USA, Venezuela, Saudi Arabia, Russia, etc.) while 70% of the copper used for industrial purposes in the world comes from six mines. This is confirmed by what has happened in the last year. The copper surplus originally foreseen for 2024 turned into a deficit due to interruptions in the production of two mines supplying the metal. This fact shows the excessive concentration of global copper production while the production of electric vehicles that demand large amounts of copper does not stop as can be seen in the following chart.

In the next ten years, Ecuador could add two or three more copper mines to the six that currently supply 70 per cent of the market, thereby increasing its influence and geopolitical importance exponentially.

Let’s dream. If Ecuador puts three copper mines into production in addition to the six that currently supplies 70% of the world’s industrial market, it would become part of the short list of five countries that supply one of the indispensable metals for the decarbonisation of the planet, which includes the production of electric vehicles, clean energy solutions, etc. It is evident that the international community, especially those countries at the forefront of decarbonisation, would give a different and preferential treatment to this small country and thus would be able to obtain advantages and preferential trade treatments for the benefit of all Ecuadorians. Ecuador’s geopolitical importance, if it manages to position itself as a world supplier of copper by developing its great potential and bringing advanced projects into production in the coming years, would also allow it to gain allies and financial backers in its fight to eradicate organised crime and mafias.

Finally, in the last 50 years, oil and gas have dominated the geopolitical competition for energy security. However, this is set to change radically as it is expected to be dominated by critical minerals and industrial supply chains in the next 50 years. Ecuador could come into its own in the next five decades.