Escrito por: César ZUMARRAGA

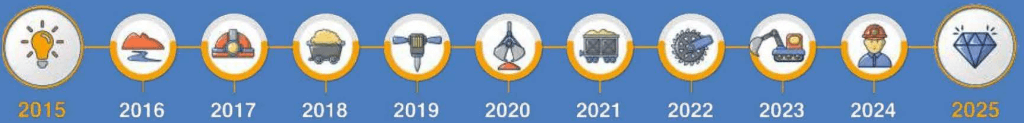

Ten years ago, dear friends invited me to contribute to this column. Minergía was established as a magazine for disseminating and discussing topics of general interest in the mining and energy sectors, addressing a gap in publications within industries critical to Ecuador’s development. Over the past decade, through considerable effort, Minergía has established itself as the most significant publication on mining and energy issues in the country, expanding its reach to Colombia and Canada, where its influence and importance have continued to grow.

Although it is often stated that there are no coincidences in life, this venture aligns with the most significant advancements the mining industry in Ecuador has achieved throughout its history.

In 2015, the mining industry was still recovering from the damage inflicted by Constituent Mandate No. 6 (known as the Mining Mandate) of April 2008. This mandate, issued by the Constituent Assembly, unlawfully confiscated more than half of the concessions in force at that time. The most radical faction of Rafael Correa’s socialist government managed to pass this Constituent Mandate with the clear intention of obliterating the mining industry, and they almost succeeded.

The same government subsequently adjusted its stance and began supporting a responsible mining industry that contributes at least half of its profits to the republic, which owns the mineral resources. The constituent assembly enacted the 2009 Mining Law, a genuine legal eyesore arising from ‘ingenious’ international mining lawyers -engaged by Correa’s government- who claimed to have approved a cutting-edge law in the region.

It was not; the 2009 Mining Law is arguably the worst mining legislation in the world. I shall not elaborate on all the shortcomings of the 2009 Law, which, being confusing and overly regulated, would not receive the approval of any legal scholar.

Despite the new mining regulations introduced in 2009, exploration companies upheld their homework by announcing several significant deposits, including Mirador, Panantza-San Carlos, Quimsacocha (now known as Loma Grande), Rio Blanco, and, of course, Fruta del Norte.

On 5 March 2012, the first exploitation contract was signed between Ecuador and Ecuacorrientes, a company owned by Chinese interests, for the development and extraction of the Mirador project.

However, 2015 marked a significant turning point for Ecuador’s mining industry, as the oil price had plummeted, causing substantial harm to the state’s fiscal coffers. This situation compelled the government to concentrate on mining as an alternative source of investment and tax revenue, urgently needed in a dollarised economy. That year also saw the establishment of the Ministry of Mining as the regulatory authority for mining policy, along with plans to reopen the mining cadastre, which had been closed for many years.

In the same year, Lumina Gold Corp, a Canadian company founded by Canadian entrepreneur Ross Beaty, one of the world’s most esteemed mining entrepreneurs, acquired the Cangrejos project, which had a long history of exploration by several operators.

In 2015, the international industry also focused on Ecuador with the announcement of the discovery of Cascabel by the Australian company SolGold, a copper and gold deposit typically found only once every decade. This discovery earned Cascabel the “Best Discovery Award” from the organisation Mines & Money, which also honoured SolGold’s CEO, Mr Nick Mather, as “Best CEO of a Mining Company” and recognised him as “Person of the Year” by the Canadian newspaper The Northern Miner.

The Mining Exploitation Contract for the Fruta del Norte project in Ecuador was signed on 14 December 2016 between the Ecuadorian government and Lundin Gold. This contract permitted Lundin Gold, a Canadian company, to operate one of the largest gold mines in the country, located in the province of Zamora-Chinchipe. The mine commenced commercial production in November 2019.

In March 2016, the Minister of Mining announced the opening of the mining cadastre during the PDAC in Toronto, using an auction process based on investment and work plans that sparked the interest of worldclass big players. Between 2016 and 2017, Anglo American, BHP, Newcrest, Hancock, and Forescue established a presence in the country.

While this was happening, other smaller projects were advancing their economic studies before jumping to feasibility, such as the La Plata project (Atico Mining), Adventus’ Domo (now Silvercorp) and Dundee Precious Metals’ Loma Larga.

The narrative of this decade also underscores the rediscovery of the Warintza project, situated in the province of Morona Santiago, Ecuador. In 2001, Lowell Mineral Exploration, founded by the esteemed geologist David Lowell, carried out initial drilling that confirmed the existence of a significant porphyry copper system. Years later, Solaris Resources, a Canadian company, acquired the project and, in 2020, initiated an ambitious exploration programme. The results have shown that Warintza possesses considerable potential as a worldclass mining district, featuring extensive deposits of copper and other strategic metals.

In the 2015 Fraser report, Ecuador improved its ranking by six points, allowing it to escape the unacceptable list of the ten worst jurisdictions. According to that year’s report: “Ecuador experienced the most significant improvement in Latin America and the Caribbean this year, and its progress enabled the jurisdiction to move out of the bottom ten. The country enhanced investor perceptions in several areas, including infrastructure (+19 points), availability of labour and skills (+6 points), and uncertainty surrounding disputed land claims (+6 points).” Not surprisingly, since that year, Ecuador has begun to ascend the Fraser ranking due to several public policy developments, such as the creation of the Ministry of Mining in 2016, the elimination of substantial taxes like the windfall profit tax, and the opening of the mining cadastre.

Since that year Ecuador has begun to climb the Fraser ranking due to several public policy developments such as the creation of the Ministry of Mining in 2016, the elimination of huge taxes such as the windfall profit tax and the opening of the mining cadastre.

Despite this wave of good news, the country failed to capitalise on and benefit from these partnerships in managing its mining resources. The contradictory and excessive regulatory burden was exacerbated by attacks from far-left activist groups that utilised constitutional mechanisms, such as referendums and protective actions, to legally challenge and suspend mining operations. The Constitutional Court, which had generated much positive expectation upon its formation in 2019, surprised many with rulings influenced by anti-mining activist ideology, raising concerns among investors regarding their trust in Ecuador’s mining sector.

In 2017, just over a year after the mining cadastre was reopened, President Moreno succumbed to blackmail from the Confederation of Indigenous Nationalities (CONAIE) and closed it once more. To this day, it has not been possible to reactivate it. Unfortunately, significant players such as Anglo American and Fortescue exit the country, and we face the risk of losing other big players, like Newcrest (now part of Newmont) and BHP.

In 2024, Ecuador’s mining exports saw a decline compared to the previous year. According to data from the Central Bank of Ecuador, between January and November 2024, mining exports generated USD 2.814 billion, marking a 9.2% decrease compared to the same period in 2023. Despite these challenges, the Chamber of Mines of Ecuador estimates that mining exports in 2024 could reach levels like those in 2023, when a record USD 3.324 billion was recorded.

Last year, the mining contracts for Cascabel and Cangrejos were negotiated, amounting to over five billion dollars ($5 billion) combined. The mining industry continues to make progress despite the challenges.

Minergía will continue in this new decade as a witness to the successes and challenges of the mining industry. Congratulations on your anniversary!

© TobarZVS

This publication contains information of general interest and does not constitute legal opinion on specific issues. Any analysis will require legal advice from the Firm.